Author: Eduardo Montero

What are the best Forex brokers in 2025?

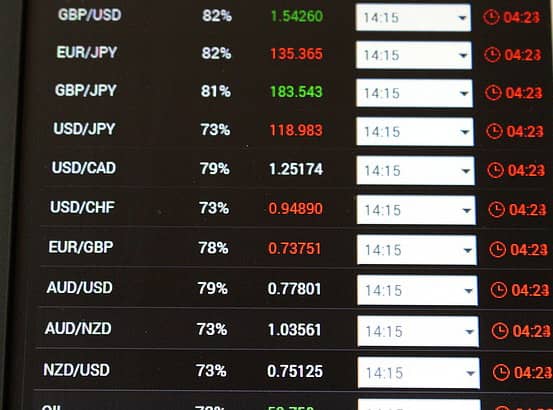

In the comparison table below you can find a list of what we consider to be the best Forex brokers with which you can start investing in the foreign exchange market safely and without complications. At Mundo-Forex.com we continuously carry out in-depth analysis and testing of online Forex brokers where we open a live trading account, deposit funds, open and close several trades and finally withdraw money in order to verify first hand that all these steps are completed smoothly:

| Broker | Key Features | Offer |

|---|---|---|

Go to XM | There are more than 55 different Forex currency pairs on XM broker. They include major, minor, and exotic pairs. Spreads as tight as 0.6 pips. Also included is free training and daily Forex market analysis.Website: https://www.xm.com/ Regulated by: CySEC, ASIC, FSC Min Deposit: 5 € / $ Trading Platforms: MetaTrader 4 + MetaTrader 5 Type of Execution: Market Maker Available Instruments: More than 1000: Wide range of Forex currency pairs. Also commodities, precious metals, indices and stocks. | Good customer support and low spreads. (*) Between 74-89 % of retail investor accounts lose money when trading CFDs. |

Go to Pepperstone | More than 60 Forex currency pairs available at the best rates directly from liquidity providers. An FCA-regulated broker provides professional trading platforms and money protection.Website: https://pepperstone.com/ Regulated by: FCA, CySEC, ASIC, BaFin, DFSA, SCB, CMA Min Deposit: 200 € / $ Trading Platforms: MetaTrader 4 + MetaTrader 5 + cTrader + Trading View Type of Execution: STP / NDD Available Instruments: More than 1200. Specialised in Forex, also offers CFDs on indices, stocks, commodities, cryptocurrencies, ETFs and currency indices. | Low spreads and ultra-fast execution. (*) Between 74-89 % of retail investor accounts lose money when trading CFDs. |

Go to IC Markets | There are over 60 Forex pairs with low spreads, with no requotes and no price manipulation.Website: https://www.icmarkets.com/ Regulated by: FSA Min Deposit: 200 € / $ Trading Platforms: MetaTrader 4 + MetaTrader 5 + cTrader Type of Execution: ECN Pricing Model Available Instruments: More than 2250: More than 60 Forex currency pairs. Also offers commodities, indices, stocks, bonds, cryptocurrencies and futures. | |

Go to Exness | Trade more than 100 Forex currency pairs at stable spreads starting from 1 pip for Standard accounts and 0 pips for Raw accounts. There are no requotes.Website: https://www.exness.com/ Regulated by: FCA, CySEC, FSC, FSCA, FSCA, FSC, SDL, CBCS Min Deposit: 0 € / $ Trading Platforms: MetaTrader 4 + MetaTrader 5 Type of Execution: Market Maker / ECN Available Instruments: Over 250 instruments including more than 100 Forex pairs, commodities, energies, stocks, indices and cryptocurrencies. | |

Go to XTB | This internationally regulated broker has over 15 years experience and you can trade over 71 currency pairs in the Forex market. Spreads as low as 0.01 pips and no requotes.Website: https://www.xtb.com/ Regulated by: FCA, FSC, CySEC, KNF, DFSA Min Deposit: 0 € / $ Trading Platforms: WebTrader + iOS App + Android App Type of Execution: Market Maker Available Instruments: Over 6100: Forex, indices, commodities, stocks, ETFs and cryptocurrencies. | Excellent customer support. (*) 76%-85% of retail investors lose money when trading CFDs with this broker. |

Go to Axi | Axi is a licensed online broker that offers access to more than 70 Forex currency pairs. It also has competitive spreads and fast execution (from 0.4 pip on the Standard account).Website: https://www.axi.com/ Regulated by: FCA, ASIC, DFSA, FSA Min Deposit: 0 € / $ Trading Platforms: MetaTrader 4 Type of Execution: STP / ECN Available Instruments: More than 130 instruments: Forex, indices, commodities and cryptocurrencies. | |

Go to RoboForex | Roboforex has a variety of professional trading platforms and over 40 Forex pairs for trades with variable spreads starting at 0 pips.Website: https://roboforex.com/ Regulated by: FSC Min Deposit: 100 € / $ Trading Platforms: WebTrader + MetaTrader 4 + MetaTrader 5 + cTrader + iOS App + Android App Type of Execution: STP / ECN Available Instruments: Over 12,000: Forex, stock indices, ETFs, commodities and stocks (over 8400 in R Stocks Trader account). | First and subsequent deposit bonus up to $50,000. (*) Bonus not available for European clients. Check conditions on the broker's website. |

Go to FP Markets | FP Markets is a broker with ECN execution. No dealing desk. Spreads as low as 1 pip on Stardard accounts. Spreads as low at 0 on Raw accounts. Over 60 Forex currency pairs can be traded.Website: https://www.fpmarkets.com/ Regulated by: CySEC, ASIC Min Deposit: 100 € / $ Trading Platforms: MetaTrader 4 + MetaTrader 5 + IRESS + cTrader Type of Execution: ECN Available Instruments: More than 10,000 tradable instruments: Forex, CFDs, indices, stocks, commodities, metals, cryptocurrencies and bonds. | |

Go to FBS | FBS broker allows you to trade more than 25 Forex currency pairs, with spreads as low as 0.2 pips (floating), from 3 pips (fixed) or without spread (with commission).Website: https://www.fbs.com/ Regulated by: CySEC, FSC Min Deposit: 1 € / $ Trading Platforms: MetaTrader 4 + MetaTrader 5 + iOS App + Android App Type of Execution: STP / ECN Available Instruments: Over 650 assets: Forex currencies, cryptocurrencies, precious metals, energies and equities. | (*) Service not available for European clients. |

Go to AvaTrade | More than 50 Forex currency pairs (e.g. 0.9 pip for EUR/USD) and multiple platforms for manual and automated trading.Website: https://www.avatrade.com Regulated by: Central Bank of Ireland, ASIC, BVI, FSA, FSCA Min Deposit: 0 € / $ Trading Platforms: WebTrader + MetaTrader 4 + MetaTrader 5 + iOS App + Android App Type of Execution: Market Maker Available Instruments: More than 200. Major, minor and exotic Forex pairs, cryptocurrencies and CFDs on indices, commodities and stocks. | |

Go to OANDA | OANDA is a broker with over 25 years experience. Offers more than 45 currencies pairs on Forex market and integrates market analysis tools into its trading platforms.Website: https://www.oanda.com/ Regulated by: FCA, ASIC, NFA, BVI FSC, IIROC Min Deposit: 0 € / $ Trading Platforms: MetaTrader 4 + MetaTrader 5 Type of Execution: Non Dealing Desk Available Instruments: More than 120: Forex, indices, metals, stocks, commodities and cryptocurrencies. |

We only list brokers that we have a positive opinion of, that are regulated and that have extensive experience in the industry. Most of them can fit perfectly into the profile of a beginner trader, interested in learning and starting to trade Forex online.

The Forex market was initially reserved only for banks, large investors and financial institutions, but in recent years, currency trading has democratised to the point that any retail trader can start trading online from their computer, or even from their mobile phone or tablet, anywhere, at any time of the day. More and more Forex brokers are emerging that allow you to start investing with very accessible deposits (from 100 EUR / USD or even less) and with very similar conditions, making it more complicated to know which broker to choose and which one is really reliable. With this comparative table and the information available on our website we hope to help you find the Forex broker that best fits your profile and that you can successfully start in this exciting world of the foreign exchange market.

Find the best forex brokers in the market in 3 steps

I recently changed my online forex broker, because the one I used to use for my trading operations was no longer good. You can invest for years – and get along very well – with a particular broker, but if your investment needs change, you may want to change brokers.

Before I changed brokers, of course, I did a lot of research, because I wanted to choose the best online broker for my operations. So here is a little useful guide for those who have to choose (or change) a broker for online trading, particularly with regard to the Forex market, so that each person can be able to choose the best broker according to their needs.

But remember one very important thing: it is not the broker who makes the difference between a successful and a mediocre trader, if you lose by trading, it is not the broker’s fault, but a poor training. You can always improve your training with our courses.

STEP 1 – Select the forex broker based on Legal information

The first step you need to take to choose a broker is to analyse the legal information. This is because if you are not sure of the security of the broker and the protection of your money then there is no point in investing. Furthermore, a very important criterion of any business is legality, which means that from the beginning you have to use a perfectly legal broker. In particular you need to look at the following points:

Registered office

You need to know where the broker has its registered office, bearing in mind that the broker may also have its registered office in a foreign country.

Regulation

The broker must be regulated by a supervisory authority. This ensures that the broker operates according to certain rules to protect traders. The supervisory authority may also be foreign, such as the FCA (Financial Conduct Authority) or the CySEC (Cyprus Securities and Exchange Commission). Of course, the broker may also be regulated by several supervisory authorities, this is usually the case with multi-national brokers, i.e. brokers operating in many countries.

More info: Comparison table of regulated brokers

Registration

To be authorised to operate in your country, the broker must be registered. Forex brokers are usually regulated or at least registered with some of the supervisory bodies in the countries from which their clients come, for example: United Kingdom, Germany, Netherlands, Australia, New Zealand, Saudi Arabia, Bahrain, Qatar, United Arab Emirates (Abu Dhabi, Dubai,…), Kuwait, Singapore, Vietnam, Indonesia, Philippines, China, Japan, Taiwan, India, Brazil, South Africa, Nigeria, Kenya, Senegal,…

Bank Segregated Account

Before you start investing and trading you must of course deposit the money into your trading account which you must open with the broker of your choice. This means that you will have to make a deposit in favour of the broker. Well, when you deposit money to a broker to trade, it must be deposited into a segregated account, which is a separate account from the broker’s corporate accounts. Keeping our money separate from that of the broker ensures that all money in our segregated account is protected in the event that the broker is in an insolvency situation. Our money cannot be used to pay the various creditors.

Therefore, first of all, it is absolutely necessary to choose a broker who offers a segregated account, i.e. who follows this separate management of the money, so even if the broker goes bankrupt, our money will be safe. It is also good to know which account (obviously in the name of the broker) to which bank we will have to deposit our money.

Fund Protection

It is not enough to have the money in a segregated account, in fact you have to choose a broker that offers a system of protection for the money you have deposited. In fact, in the event that the broker is unable to meet your claims, i.e. if the broker is unable to return the money to its clients, you will be entitled to compensation through the deposit protection system. For example, many brokers use the UK’s FSCS (Financial Services Compensation Scheme) as fund protection, which provides coverage of £50,000 for each client of the broker. In this respect, and all other things being equal, if a broker offers greater fund protection, it is of course preferable.

STEP 2 – Select the forex broker according to your Operation

The operation of a trader is different from that of another trader: in short, each trader has his own specific way of investing. Some invest in shares, some in Forex, some in options, some in commodities, and so on. And then there are those who invest in the short term, those who invest in the long term, there are scalpers, etc.. The same thing is true for online brokers: each broker is different from another, there are generalist brokers, those specialized in Forex, CFD brokers, those specialized in stocks… So the second step you need to take in order to choose the best broker is to select those brokers that offer the best offer in terms of your operations.

In particular you need to examine the following points:

Markets Offered

You need to know which markets the broker allows you to trade in. In practice this means choosing specialist brokers in those markets where you want to operate. For example, if you are a trader who invests in Forex, it is good to go to those brokers who specialise in Forex, and forget about the general brokers, such as the brokers of banks which may allow you to invest in many markets, but which may offer only a few currency pairs, thus limiting your operations.

Hours

In addition to knowing the markets offered by the broker, you also need to know at what times you can operate in the markets of your interest. In fact, for certain financial markets brokers offer different hours of operation, so it is a good idea to choose a broker who offers the widest range of operations in terms of time as regards the markets in which you intend to operate.

Financial Instruments

You need to know the financial instruments through which the broker allows you to operate in a given market. In fact, if two traders invest in the same market, they may not do so with the same instrument. For example in the Forex market you can operate in different ways, but the main ways to operate are either through Spot or through Contract For Difference (CFD). So if you want to trade Forex, you need to know whether you will trade through Spot or CFDs. This is also and above all because different financial instruments have different costs. We will talk about trading costs in a moment.

Broker Type

How many types of brokers are there? The use of various acronyms such as MM, DD, NDDD, ECN and STP can lead us to think that the categories of brokers are much more numerous than they actually are, and consequently lead us to total confusion. Thankfully, however, the situation is not that complicated, so let’s try to shed some light on this.

Difference between Dealing Desk and No Dealing Desk

First of all with the acronyms DD (dealing desk) and NDD (No dealing desk): in the first case the broker acts as a real counterparty to the trader while in the case of NDD these act as a ‘link’ between the investor and the interbank market. In practice these are two macro categories that enclose what are the real types of brokers or rather:

- Market Maker or MM;

- Electronic Communication Network or ECN;

- Straight Through Processing or STP.

The type of broker that falls under DD is the Market Maker.

With the market maker you have the application of the ‘requote’, i.e. the execution of the order request can take place under different conditions respecting those of insertion or execution request. In simple terms it is the broker himself who ‘makes the market’. On the other hand, for ECN and STP, since requote is not provided, we speak of broker No Dealing Desk (orders are executed at the conditions present on the market).

Obviously, the fact that the broker does the market or only acts as a conduit leads to two different consequences: in the first case, that of the market maker, there is the certainty of order execution, while in the second (the NDD) it may happen that an order cannot be executed because there is a lack of liquidity to do so. Let’s go even more into the detail.

Market Maker features

As already mentioned in the case of market makers there is no ‘direct’ relationship between the trader and the market (be it Forex, ETFs, etc.) but it may be the broker itself as a counterparty. This, in addition to the above mentioned requote, leads the Market Maker brokers to present some peculiar characteristics (positive and negative) that make them very popular especially among small investors and those at their first trading experiences. Among these peculiarities we find:

- provision of easy-to-use and generally customisable platforms with good flexibility;

- low amounts for initial deposits and trading (at least in mini or standard accounts);

- provision of information support and training at various levels;

- presence of demo accounts;

- application of medium-high spreads but absence in most cases for variable commissions.

ECN features

As a No Dealing Desk, an ECN broker offers a high speed of order execution only if the market is covered on the opposite side of supply or demand. An ECN broker merely executes the order by acting as an intermediary according to the conditions on the interbank market.

Normally it also provides a transparent system of information on the actual price and volume conditions in the market chosen for trading. The system is the multi-level Book system. As main characteristics we can synthesize the following peculiarities:

- order execution speed;

- no guarantee of liquidity;

- price guarantee of the interbank system;

- application of commissions on the volume traded;

- transparency of key information;

- no influence on the market.

STP Features

Even an STP broker is no dealing desk, but unlike the ECN, which has a similar functioning with direct access to the interbank market at the real price applied, it does not provide the same transparency in terms of information. It is a system in which the transfer and execution of orders takes place in a fully computerised manner. In addition, while there are ECNs that have also opened up to retail clients, STPs continue to be a trading ‘conduit’ accessible only for assets of a certain size.

Straight Through Processing guarantees direct access to the market and rapid execution of orders (but not the guarantee of execution under any market conditions). They generally tend to apply a system of profit derived from spreads or spreads plus variable commissions.

Support

In case of doubt it is better to speak in the language you know best. This allows you to better articulate the question you ask and to go deeper into the subject by asking further questions, should the need arise. For this reason it is good to choose a broker who has a website in english and offers assistance and support in english. We also recommend a broker that allows you to communicate through different channels: telephone, chat, email,…

In this way, depending on your mood (or urgency) you can use one channel of communication rather than another. Moreover, if you use the chat of the site or the email to communicate with the broker, you can save the conversation and then in the future go and see it again, if you don’t remember something well (after years it is absolutely normal).

Financial Leverage

Leverage is what has revolutionized the way of trading, because it has given ordinary people the opportunity to trade and invest with little money, sometimes even less than 10 euros.

Before leverage this was unthinkable, and it took a lot of money to invest. For example, if you wanted to buy a Euro/Dollar contract first, you had to have (and spend) 100,000 Euros. Nowadays, however, thanks to the leverage, to buy the same contract you only need 250 euros in your account, sometimes even less. So, with 250 euros, I can buy a 100,000 euro contract. It is therefore clear that by doing so the gains (but also the losses) are greatly amplified.

As far as you are concerned, it is good to choose a broker that offers high leverage, this way you will not have to have so much money in your trading account. For example, to trade in the Forex market, bank brokers generally offer low leverage, such as 1 to 20 or 1 to 50, whereas specialist brokers offer much higher leverage, such as 1 to 100 or 1 to 400 or even more. It is therefore clear that the latter are the best choice.

A synonym for leverage is margin, so when we are talking about margin, in practice we are talking about leverage, and vice versa. Numerically, the margin is given by 100 divided by the leverage. For example, saying leverage 1 to 200 or margin 0.50% is the same thing. So if you use a leverage of 1 to 200 and you want to buy a Euro/Dollar contract of 100,000 euros, just have 500 euros in your account and you can buy it. As you can see the leverage is 1 to 200, because with 500 euros you buy something that costs 200 times as much, and the margin is 0.50%, because this percentage is the ratio between 500 and 100,000.

Trade-Out

Trade-out is a subject closely related to leverage. Many brokers also call it margin call. In practice it represents the level above which the trade is automatically closed at a loss, even if you have given no order to close it. It is therefore an automatic protection. For example, suppose you have 10,000 Euros in your account and you buy a 100,000 Euro/Dollar contract. Let’s assume that you operate with leverage 1 to 100 and a trade-out level of 30%. To buy this contract you are asked for 1,000 euros as margin (because you have a leverage of 1 to 100, so the margin is 1.00%), in practice you are “locked” in your 1,000 euros account.

Suppose you make a mistake and you start losing 3,000 euros, then 4,000, then 5,000 and so on until you reach the point where you are losing 9,700 euros: now you just need to lose 1 cent more than this amount, and the operation will be closed automatically. This is because you are operating with a leverage of 1 to 100 and a trade-out level of 30%. This percentage refers to the margin, which is 1,000 euros. So as soon as you lose more than 9,700 euros the trade is closed, leaving you with 300 euros (or 30% of the margin) in your account. If you trade out 100%, the same trade will be closed automatically when you lose 9,000 euros, leaving you with 1,000 euros (100% of the margin). Of course these are very rare scenarios.

Those who invest, knowing what they are doing, are virtually never in these situations, because they always have the situation under control and therefore never reach the trade-out level. In fact, all you need to do is use stop loss and the problem is solved. However, for the purposes of choosing a broker, it is good to choose a broker that offers a low level of trade-out, in this way you can be more free in your operations and use your money more.

Trading Platform

Forex platforms are basically divided into three types: standalone, web-based and mobile.

- Stand alone. These are the platforms that physically must be downloaded and installed on your computer like any normal program like Metatrader 4 and 5 (More info: MetaTrader 4 Brokers or MetaTrader 5 Brokers). They are generally the most used and the most complete that allow you to trade in the most professional way.

- Web Based. These are the platforms through which you can trade directly online without having to download anything to your computer. The main advantage of these platforms is of course the flexibility, i.e. the fact that you can trade from any computer with an internet connection.

- Mobile. These are the platforms that allow you to trade through mobile devices, i.e. smartphones and tablets

Sometimes, in addition to the platform provided by the broker, it is also useful to have additional tools to help us make our trading decisions. One of the tools I use is Trade Ideas. Here is a Trade Ideas coupon code that can save you 45% off the subscription price. In this link you can also find out which are the best AI trading bots for stocks.

Trade Size

The trade size is the amount of contracts that allows you to open a broker. Each broker for each market has a minimum trade size and a maximum trade size, and you need to get to know them to see if they can limit your operations. For example, it could happen that to operate in a market, a broker will require you to open a minimum of 10 contracts, so if you wanted to buy only 2 contracts, you couldn’t do it, and therefore you couldn’t operate, except to buy a minimum of 10 contracts. For this reason it is good to choose a broker that offers a very low minimum trade size and a very high maximum trade size.

Limitations

You need to know if the broker applies any restrictions, of any kind and even momentarily, to your operations. This is because otherwise you may find out when you are operating and then when it is too late. In any case, for the purposes of your choice, it is good to choose a broker who does not apply limitations to your operations.

Bonuses / Promotions

Many brokers offer a bonus when you pour money into your trading account. For example, if you pour 1,000 euros into your account you get 2,000 euros, in fact the broker gives you 1,000 euros. The bonus can be a good thing, but in some cases it can also have negative aspects, so always be well informed if you want to take advantage of a bonus or another promotion.

All things being equal, it is a good idea to choose a broker who offers a high bonus or advantageous promotions, as long as, as mentioned before, the bonus has no negative aspects, i.e. there are no limitations on operations, or on withdrawing the money you have deposited or anything more important than the bonus itself. For example, don’t choose a particular broker just because they offer you a high bonus and ignore the legal information of the broker. Perfect legality is more important than giving away 1,000 euros!

STEP 3 – Select the forex broker according to costs

Generally speaking, brokers specialising in a given trading sector are the ones who offer the best offer also with regard to the specific costs of that way of trading. So, after selecting a few brokers based on your legal information and the way you trade, the time has come to select the one that is most cost-effective, i.e. the broker that allows you to invest at the lowest possible cost. The costs of trading can be viewed on each broker’s website and are of different types.

Knowing the costs of your way of trading is very important because, as we have just said, one trader’s operations are different from those of another. And therefore, not all ways of trading cost the same. For example, whoever invests in the very short term for the same profit will have to pay the broker more than who invests in the long term, simply because he will have opened many more trades. So the third step you need to take in order to choose the best broker is to be well informed about all the costs of trading. In particular you need to examine the following points:

Spreads

The spread is the difference between the price at which you buy and the price at which you sell a particular financial instrument. For example if I can buy a Euro/Dollar contract at 1.3528 and sell it at 1.3526 the spread is 0.0002 (i.e. 2 pips). The spread varies from broker to broker, so different brokers have different spreads (Which brokers have the lowest spreads?). So if I operate on the Euro/Dollar a broker could have a spread of 1 pip while another broker a spread of 2 pips. For the purposes of your choice, all things being equal, you must choose a broker who offers a low spread, especially if you are scalper (brokers for scalping) or short-term.

Commissions

In addition to the spread, the broker’s profit is also given by commissions, which represent an amount to be paid, usually fixed, to buy and/or sell a certain financial instrument (shares, indices, currencies, etc.). As with the spread, commissions vary from broker to broker, and depending on the market some brokers do not charge any commission. Again, this is very simple, all things being equal, you must choose a broker who offers low commissions, or even zero commissions, as these will negatively affect the final balance of your operations, especially if you operate with low capital.

Interests

In addition to the spread and commissions, the broker’s profit is also interest. In fact, if you operate on certain markets with certain financial instruments your transactions will be subject to interest. The mechanism is very simple, by opening a trade and keeping it open sometimes you receive interest and sometimes you pay it. For example if you buy a Euro/Dollar contract you receive interest, while if you sell the same contract you pay interest.

The point is that very often brokers charge you whether you have a long open position or a short open position, so in practice you never receive interest. This is because these brokers add a commission to the interest rate you should receive. Because this commission is almost always higher than the interest you receive, you are forced to pay. For example if you receive 1 euro interest but pay 2 euro commission on this interest, you actually have to pay the broker 1 euro. This is why with certain brokers you pay both when you receive interest and when you pay it. In the long run this can have a very negative effect on the final profit of your operations, especially if you invest in the long term, because you pay interest every day.

However, fortunately for you, there are brokers who do not apply this mechanism, so sometimes you will pay interest on your open positions and sometimes you will receive it, as you should (e.g. if you are long you are credited with interest, if you are short you are charged interest, or the opposite, it depends). In any case, remember that only some markets and only some financial instruments are subject to interest. In this regard, investing in Forex through CFDs (a derivative financial instrument) is generally more expensive than investing in Forex through Spots, because with CFDs brokers usually use the mechanism I have just explained, so you will be charged interest, always and in any case, regardless of the position of the transaction (long or short).

I discovered this fact personally and on my own skin, because I used to invest in Forex with a broker using CFDs; I paid a lot of money between interest and additional commissions that I could save and dedicate to trading. When you choose a Forex broker, if you want to trade in certain markets with financial instruments subject to interest, all things being equal you have to choose a broker that offers the best interest, as pure as possible, i.e. without commissions: in this way sometimes you will receive interest and sometimes you will pay it.

Trading Account

In addition to the spread, commissions and interest the broker’s profit can also be given by the trading account you open. However, nowadays, almost no broker charges for a trading account. In any case, it is always good to ask and inquire, after all, it costs nothing to ask. If it’s true that brokers no longer charge for a trading account, it’s also true that if you don’t operate for a long period of time, i.e. if your account is inactive for a long time (e.g. a year), then there may be some expenses. So also be aware of downtime and make sure that you never leave your account inactive, otherwise you will incur expenses. For the purposes of your choice, all things being equal, you must choose a broker who offers the opening of the trading account, the maintenance of the trading account and the closing of the trading account completely free of charge and low inactivity fees.

Deposits / Withdrawals

The last cost you may be forced to incur relates to deposits you make into your current account and subsequent withdrawals. In any case, please note that brokers offer ways to transfer money for free and for a fee, depending on the instrument you use to deposit and withdraw. For example, if you transfer money by bank transfer the broker does not charge you any commission, but if you transfer the same amount of money by credit or debit card the broker may charge you a commission of 1.5% (just to give an example).

So be aware of the various ways to deposit and withdraw, the costs involved and even the minimum amounts to make a deposit or withdrawal. To make your choice, all things being equal, you must choose a broker who offers free deposits and withdrawals.

It is also convenient to pay attention to the payment methods offered by the broker. Most brokers allow credit cards, bank transfers,… but there are other brokers that accept PayPal and other electronic payment methods such as Skrill or Neteller, which are usually more convenient, safer and faster than traditional bank payment methods.

Conclusions

In addition to everything you read above (I know it’s a lot of stuff) what I recommend, to choose the best Forex broker, is to create an excel file where in the rows you put the names of the brokers and in the columns you put the names of the information to ask that I have shown you. This way, once you have the information from the broker, you can mark it in the box corresponding to the row and column. For example, ask the broker XYZ what leverage they have and they will tell you 1 to 100. Then write 1 to 100 in the box identified by the XYZ row and the Leverage column. You can create something similar to this table (perhaps with all the columns we’ve talked about):

Broker Registered Office Regulation Markets Instruments Service in your language Leverage

Broker 1 Australia ASIC Forex and CFD Yes 1:50

Broker 2 Cyprus CySEC Forex and CFD Yes 1:30

Broker 3 United Kingdom FCA Forex, CFD Shares Yes 1:30

By doing so, repeating the operation for all the boxes and all the other brokers, you will eventually have an excel file that contains all the information you need to compare brokers against each other and then choose the best Forex broker for you and your way of trading.

Mundo-Forex.com

Welcome to Mundo-Forex.com, the web portal addressed to all those people interested in learning how to invest in the Forex currency market, providing them with practical, concrete and realistic information.

Here you will find all kinds of tools useful to trade intelligently in the exciting world of trading. For example our free forex course, trading strategies, a good economic calendar, real time quotes, analysis of online brokers and comparisons of the best forex brokers, offers and promotions, news and much more.

This page is also available in Spanish: Mejores Brokers de Forex, German: Beste Forex-Broker