Author: Eduardo Montero

In this article we will analyse the features of the Pepperstone broker and see in detail what its clients think about its services in order to find out what the main advantages and disadvantages of this financial intermediary are.

Pepperstone is an ECN/STP execution broker founded in Melbourne, Australia, in 2010, whose mission is to offer high execution speed, gross spreads and low commissions.

Key features of the Pepperstone broker

Analysing the official website of this broker (https://pepperstone.com/) and the main opinions of real clients that we have found, we can point out that:

- It allows you to trade over 800 different financial instruments across a wide range of markets such as FOREX, CFDs and Commodities.

- MT4, MT5, TradingView and cTrader are available free of charge for computers, mobiles and tablets, they also offer a web application that works in any browser.

- Most orders are executed at speeds of less than 30 milliseconds or so, which scalpers and traders using trading robots appreciate.

- It is highly regulated by the major industry regulators such as CySEC, the FCA, ASIC, and the CMA.

- Its investors’ funds are held in segregated accounts that are custodied at top-tier banks.

- It allows traders to run automated algorithmic strategies, as expert advisors, uninterrupted on a virtual machine hosted on a VPS (Virtual Private Server).

- It has multiple market analysis and management tools including Smart Trader Tools, cTrader Automate and Autochartist.

- It has a wide range of online resources, trading guides and webinars in English by trading experts.

- Allows social trading (only available in some countries).

Pepperstone broker reviews

Our main objective with this type of article is to give you an idea of our opinion on a particular broker (Pepperstone in this case), but also a summary of some of the most important comments from its clients, both positive and negative, so that you can build your own assessment and decide whether or not to invest with this financial intermediary.

We have made a search through the different blogs and broker review websites to locate those comments (both good and bad) left by Pepperstone’s clients, filtering and eliminating of course those that have no real basis and are largely derived from errors due to the user’s own lack of knowledge.

The security of a broker is essential to establish trust between the two parties, since we are going to deposit our money, in this aspect, customers are satisfied because from its rigorous account opening process to its fund protection program, it is seen that this broker likes to comply with its regulations, which are not few.

Although some more demanding clients do not like the idea that they have settled in Cyprus. Depending on your country of residence, the broker offers its services from a certain company and regulation. Some regulations are stricter than others, but this is a highly regulated international broker that offers quite high security standards compared to other brokers that do not have the same number of regulations.

As for Pepperstone‘s commissions, many of its clients are satisfied while others find them a bit high, especially spreads on exotic pairs and hand deposits.

Another aspect of Pepperstone that is well appreciated by its clients is its trading platforms, as the broker offers a comprehensive portfolio, including the integration of Trading View via cTrader. They also found the mobile versions to work very well, with excellent execution speed.

According to the majority of Pepperstone’s customer reviews, customer support is excellent, responding to your queries quickly and resolving any questions or issues you may have.

If you are interested in contrasting these reviews of Pepperstone with those we have collected from other brokers, you can see these articles in which we analyse, for example, reviews of IC Markets,reviews of XM or the reviews of XTB broker.

Main Advantages and Disadvantages of Pepperstone

Like any financial intermediary, Pepperstone has its good and not so good things, let’s take a look at what we have found about this particular broker.

Advantages

- It has multiple trading platforms: We will be able to trade on the well-known MT4 and MT5 platforms, in addition to the cTrader platform and the integration with TradingView (view brokers with TradingView platform), all available for computers on Windows and Mac OS, iOS and Android app for mobile devices. In addition, we can also make use of its WebTrader accessible from any browser.

- Possibility of Social Trading (only available in some countries): With the use of platforms such as Myfxbook and DupliTrade, we can carry out automatic trading. In the case of Myfxbook, which is nothing more than an account duplication service, we can copy transactions from the main currency trading systems. DupliTrade, on the other hand, allows you to gain access to DupliTrade’s strong portfolio of leading strategy providers, which are automatically traded on your own MT4 account.

- Multiple analysis and management tools: Without a doubt, a good analysis and management of the markets reduces the investment risks involved. For this reason, Pepperstone offers its clients a wide range of tools that help to cover the lack of knowledge and understanding that some clients may have, especially when they are novices. Smart Trader Tools, cTrader Automate and Autochartist, are the main analysis and management tools that we can count on when trading with this broker.

- Relatively low spreads: If we compare the spreads offered by this broker for most of its assets with those of other similar brokers, we can see that they are quite competitive and often lower, without taking into account that those of Razor accounts are even lower.

- Multiple currencies as the base currency of the account: Allows you to choose as the base currency of the trading account several different currencies such as the Dollar, Euro, Pound Sterling and Swiss Franc. This is very helpful as you can often save on currency conversion fees.

- Allows trading with expert advisors: MetaTrader 4 and MetaTrader 5 are very popular platforms for following automated trading strategies through expert advisors, Pepperstone knows this and that is why it allows its clients to use this feature to trade day and night on the financial markets.

Disadvantages

- Small number of instruments: Although Pepperstone allows access to more than 800 financial instruments in Europe and more than 1000 in other countries, we can say that this number is significantly lower than in other similar brokers that offer up to more than 3000 different assets.

- Auto Trading through Myfxbook only for real accounts: As this possibility does not exist for demo accounts, users may have difficulty when learning to manage this service, likewise, you should know that this is a service only available in some countries.

- Carryingout auto trading through Myfxbook can be complex: Despite being considered an advantage of the broker. The way to access and implement this service can be a bit complex for most users who access the platform, especially if they are customers who are starting in the world of financial markets, likewise, you should know that this is a service only available in some countries.

- Limited Demo Account: The demo account can only be used for 30 days. In case you want to extend it, Peppersotone puts as a condition to have real balance in your account and request the non-expiration for the demo account.

Features of the Pepperstone broker

Let us now take a step-by-step look at the features and opinions of each aspect of the Pepperstone broker.

– Opinions on the markets that can be accessed with the broker

Although it is not one of the brokers with the largest number of instruments available, it certainly offers a wide range of assets, enough for most of the common traders, and even professionals can be satisfied, and this has been expressed in some comments and opinions of its clients.

Let’s see what are the details in terms of markets and assets available.

Forex

- It allows trading with more than 61 currency pairs.

- Spreads for Razor accounts range from 0.0 pips, while Standard accounts start at 0.6 pips.

- It allows trading in a considerable number of currencies (Dollar, Euro, Yen, British Pound, Franc, Canadian, Australian and New Zealand Dollars).

- Leverage varies depending on the client’s region of residence.

Indices

- Over 20 indices can be traded.

- Allows trading with a fixed spread on CFDs on Indices during market opening hours, which can vary from as little as 0.3 pips.

- As with the previous market type, leverage varies depending on the client’s region of residence.

Shares

- For clients from Europe it allows trading over 250 stocks from all over the world, while for clients from other countries can be over 1000 stocks.

- Instead of charging the difference between the bid and ask price (spread), peppersotone charges a commission of 0.02 USD per US share, 0.10% on German shares and 0.07% on Australian shares.

- Leverage also depends on the client’s country of residence.

Commodities

- Over 30 different types of commodities can be traded.

- Spreads for commodities are relatively low starting at 0.05 pips.

- The maximum leverage for European retail clients is 20:1, while for other countries retail clients can be as high as 200:1.

ETFs

- It allows trading in more than 100 ETFs.

- Instead of charging you the difference between the bid and ask price, Peppersotone charges a commission ranging from USD 0.02 per share on each trade when you open and close a position.

Cryptocurrencies

- You can trade 20 different cryptocurrencies including (Bitcoin, Ethereum, Litecoin, Cardano, Polkadot, Ripple, among others).

- Spreads are relatively low starting at 0.0 pips for cryptoassets such as (Ethereum, Litecoin, Polkadot and Dogecoin). In the case of Bitcoin the minimum spread can be 30.

- The maximum leverage on standard accounts in the European region is 2:1 and 10:1 for Pro accounts, while for retail accounts in other countries can be as high as 20:1.

Currency indices

- We can trade 3 types of currency indices (US Dollar Index, Euro Index, Japanese Yen Index).

- The minimum spreads for these rates are:

- US Dollar Index (6),

- Euro Index (0.6)

- Japanese Yen Index (1)

- Maximum leverage for retail accounts in the Europe region is 10:1 while for retail accounts in other countries retail clients can be as high as 100:1.

– Types of accounts available at Pepperstone

Pepperstone has a number of accounts that aim to meet the needs of the majority of its clients. Some of the common features of these are:

- Minimum trade size of 0.01 lots (1 micro lot)

- Maximum trade size of 100 lots

- Base Currencies available: GBP, USD, EUR, CHF

- Scalping allowed

- Expert advisors allowed

- Hedging allowed

Standard Account

This account type is recommended for beginners. The standard account offers institutional grade spreads allowing you to trade free of additional commissions such as the well known spreads, and if charged can vary from 0.6 pips for currency pairs such as EUR/USD.

Razor Account

Like Standard accounts, Razor accounts apply an institutional grade spread with variable spreads from 0.0 pips to 0.3 pips. Despite having a lower spread per instrument, Razor accounts charge a commission of 5.23 euros for opening and closing positions once you reach $100,000 traded.

It is also worth noting that these accounts are recommended for Scalpers and algorithmic traders.

Demo Account

In addition to the two previous accounts, Pepperstone offers the possibility to practice and test its platforms with a demo account, with which you can access the main functions and features of the broker.

The demo account starts with an amount of 50,000 virtual dollars with which we can test our strategies without the risk of losing real money. Demo accounts automatically expire after 30 days, unless you have a live account and request to set it as non-expiring.

We have found customer reviews and opinions that the demo account works excellent, with no limitations other than trading with fictitious money.

– Reviews of Pepperstone trading platforms

Pepperstone has not dared to experiment with its own platform, therefore it allows its clients to use the most widely used platforms in the world such as:

- MT4

- MT5 DEMO ACCOUNT

- cTrader

MetaTrader 4

Using this platform gives you access to over 80 pre-installed indicators and analysis tools that allow you to make informed decisions, as well as 28 additional Smart Trader Tools. In addition, MT4 allows automated trading 24 hours a day without you being present. It also offers the possibility of backtesting for expert advisors.

Available for Windows and Mac OS PCs, iOS or Android phones, and browsers via a webtrader.

MetaTrader 5

This has better processing speeds as it is more optimised than its smaller sister MT4. It allows you to hedge your positions with the ability to place up to 500 orders in total. This version features 38 additional indicators and an excellent economic calendar with the ability to view up to 21 different types of calendars. One of the key elements is its compatibility with Pepperstone’s Autochartist and Smart Trader Tools packages.

Also available for Windows and Mac OS PCs, iOS or Android phones and browsers via its web version.

cTrader

cTrader is an intuitive and easy-to-use platform which, although not as popular as the previous platforms, also offers advanced features and customisation options. It also has a wide range of indicators. It has detailed order tickets, including the dollar value of the base currency or the distance in pips.

Another advantage of this platform is the ability to add multiple take profit orders for staggered profit taking. It also has full educational videos integrated into the platform. Not to mention the fact that most of the charting tools also available on Meta Trader are integrated.

Pepperstone has recently added the ability to sync your accounts with the Trading View platform, one of the best trading platforms of recent times, thanks to its link with cTrader.

This latest integration feature with Trading View is making many clients want to choose Pepperstone as their financial intermediary, and they have made this clear in some comments.

– Analysis and training tools

Pepperstone wants to ensure that its clients can make the best possible profits, which is why it provides its clients with a set of sophisticated tools that will enable you to make better investment decisions.

Some of these tools are:

Smart Trader Tools: Not a tool per se, but a suite of tools from expert advisors that will allow you to improve the execution and management of trades.

With 28 smart applications, including expert advisors and indicators, this suite allows you to build near-perfect strategies, manage your risks and improve your overall experience.

These smart applications are easy to install, access and use, and are exclusive to the world’s most robust platforms: MetaTrader 4 and MetaTrader 5.

cTrader Automate.API: It is specifically designed for margin trading and uses a programming language that is easy to read for both developers and traders. The API functionality is extensive and supports almost anything you can imagine in relation to forex and CFD trading.

Autochartist: A unique market analysis tool that displays statistically significant market movements and also serves to identify important price levels that have proven to be catalysts for market movements.

The Pepperstone version of this tool has a built-in filter for market events that have been shown to report significant value over 6 months of backtesting. It also includes a drop-down list function where you can select patterns and minimum probability values in the past.

News and Economic Calendar: Pepperstone offers a wide range of news related to major economic events around the world. And as a bonus, it also provides an economic calendar where you can find out the date and time when each of these world economic events will occur.

Education: In the education section of the main menu we will be able to access a large number of contents related to financial education separated by topics. We can find content to learn how to trade Forex, as well as CFDs and Cryptocurrencies.

Pepperston’s retail and beginner clients are, although not the only ones, the ones who benefit the most from all the educational material and analysis tools that this broker makes available to them, as they help them to make better investment decisions, and this has been reflected in some opinions that have been left on websites such as Trust Pilot, or other review websites.

– Pepperstone’s main commissions

In every review of any broker you can not miss a look at their fees, as it is often the reason for numerous comments and opinions, sometimes for good and sometimes for bad.

And this happens because this aspect to a greater or lesser extent affects any trader regardless of their trading style.

Pepperstone, being an ECN/STP broker and not having its own trading desk, only earns its fees through the commissions and fees applied, as it does not act as a counterparty to your trades.

We can separate their fees into two groups:

- Operational fees

- Non-operating commissions

Operational commissions

Pepperstone charges a minimum commission of A$3.50 per transaction on major currencies and US$0.02 per share when opening a CFD position on shares.

Spreads: The spread is the difference between the bid and ask price of a given asset. Pepperstone applies this type of commission on a variable basis, i.e. it is highly dependent on the behaviour of the markets at the time of trading.

For Razor accounts, spreads typically range from 0.0 pips for pairs such as EUR/USD and up to 106.58 pips on EUR/ZAR.

It is worth noting that excluding some particular instruments, the spreads on these accounts are relatively low compared to other similar brokers.

However, some clients complain that on the Razor accounts (which do charge commissions), the spreads are practically the same for exotics compared to the Standard account (which does not charge commissions). They therefore believe that they are overpaying commission.

In addition, some believe that in general the spreads are somewhat high.

Overnight rates: The swap rate is set according to the regional benchmark interest rates for the underlying product, and is usually around 2.5%. To access Pepperstone’s overnight swap rates, we must manually access each of the instruments on each platform, either MetaTrader or cTrader, but it is important to clarify that the swap rates published on each of Pepperstone’s platforms are indicative rates and are subject to change depending on market volatility.

To view these commissions on the MetaTrader platform you will need to:

- Select ‘View’

- Right click on ‘Market Watch’ and select ‘Symbols’

- Then choose the currency pair you wish to check and select ‘Properties’ (in MT5, ‘Specification’).

If you wish to view swap rates on cTrader:

- Go to the ‘Finder’tab

- Type the name of the symbol in the search bar

- And click on the information icon next to the symbol you wish to view its settings.

Non-operating commissions

Fees for depositing and withdrawing funds

First of all you should be aware that the means of deposit and withdrawal available to each user depends on their country of residence.

For both deposits and withdrawals, Pepperstone does not charge any extra fees if you use a credit or debit card, but for other electronic means such as Neteller or Skrill there will be a fee of $1 USD for each transaction.

On the other hand, if you withdraw via international bank transfer, the fee is $20 USD.

Inactivity fees

We have not found any information related to charging fees for account inactivity on the Pepperstone website, so we have asked support and they have replied that no, there is no account inactivity fee.

You can find out more about Pepperstone’s fees in this article: Pepperstone Fees and Commissions.

Is Pepperstone a safe and reliable broker?

Security is a fundamental aspect when deciding whether or not to use the services of a particular financial intermediary. So we never overlook this important element.

In the case of Pepperstone, it seems to be a fairly reliable broker, this, taking into account that it is regulated by the main international and prestigious regulatory bodies.

Generally, each of these entities responds to a specific area or zone where the headquarters representing the broker in that region is subject to the supervision of that entity.

For example..

Pepperstone Group Ltd is authorised and regulated by the Australian Securities and Investments Commission (ASIC) under number ACN 147 055 703 and holds an Australian Financial Services Licence (AFSL).

In Europe, based in London, Pepperstone Limited is regulated by the London Financial Conduct Authority (FCA) under licence number 684312. The FCA is one of the most rigorous financial supervisors in the world today.

It is also regulated and licensed by the Cyprus Securities and Exchange Commission ( CySEC ), the Dubai Financial Services Authority(DFSA), the Securities and Exchange Commission of The Bahamas (SCB) and the Competition and Markets Authority ( CMA ).

Many clients of this broker have been able to verify the veracity of these regulations, which is why they consider it to be a reliable and safe broker.

– Protection of your funds

If the broker goes bankrupt, it is required to join a guarantee fund (compensation fund). In the event that payments have to be suspended due to insolvency, this fund compensates each client with a maximum balance that varies depending on the regulations affecting your country of residence.

In addition, Pepperstone cannot misuse funds, as the regulatory body requires that each client’s funds must be segregated and held by a bank outside the broker itself.

This prevents the broker from using the funds for purposes other than fulfilling trading orders. It cannot even use the funds to cover a temporary liquidity need.

The money is held in a bank account, with an entity, which works, but does not belong to Pepperstone. Nor can these client funds be seized or affected by the financial situation of the company.

To reinforce its security, the broker Pepperstone itself has taken out insurance with Lloyds, which is also designed to indemnify clients in the event of any kind of problem.

Seeing all these regulations and obligations that Pepperstone has to comply with, it is hard to believe that it is not a safe and reliable broker. We have found some reviews that reinforce the opinion that this financial intermediary is highly reliable.

What user profile is this broker suitable for?

If we take into account that Pepperstone offers various account types, access to different platforms and plenty of educational material, we can safely say that this broker is excellent for traders who are just starting out in the world of trading.

But in addition to that, bearing in mind that this broker complies with all its regulations and offers an account for professional clients who handle large sums of money on a monthly basis, we can also be sure that it can be an excellent broker for those who already have experience investing in the markets and are on their way to becoming professional clients.

Another aspect that reaffirms our opinion is the possibility of trading from Trading View, a powerful and innovative trading platform designed for both novices and professionals, as it is intuitive and easy to use while offering the most advanced indicators and tools.

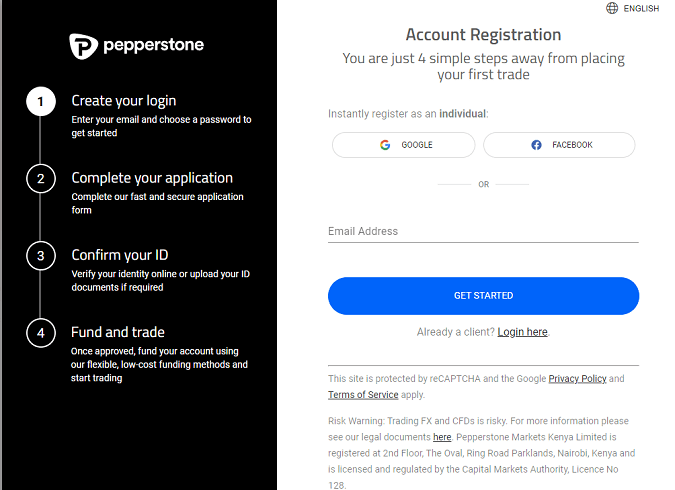

How to open an account with Pepperstone broker?

Opening an account with Pepperstone is relatively simple and free, but you will need to have certain documents on hand as these will be required to complete the process and verify the account.

1- The first step is to access the official Pepperstone website:

2- To open an account, go to the home page and select ‘Create account > Open a trading account.

3 – Once you have accessed the registration form, you can continue by entering an email address or by using your Google or Facebook account.

4 – We then need to specify the type of account we wish to create and the password for the account.

5 – The system will ask you to complete an integration test and you will need to provide identity documents to open the account. These can be uploaded during the process.

6 – The management team will then receive and review your completed application. When your documents are verified, Pepperstone will send you the login details so that you can access your trading account as soon as possible.

Due to the Australian Anti-Money Laundering and Counter Terrorism Financing Act 2006, or similar in other regulations, Pepperstone is required to verify your identity before you can open an account.

There are many conflicting opinions regarding this opening process as many see the process as tedious and complicated, while others see the positive side as being for the security of the clients themselves as well as avoiding problems with withdrawals.

To verify your identity, Pepperstone uses a scale of points up to 100. Below we list the documents required and the amount of points you get for providing each of them to validate an account.

Primary photo ID –(70 points), one of the following:

- Passport

- Driving licence

- Government issued photo ID

Requirements

- Must show full name and date of birth

- If document is certified or notarised, add 30 more points (100 total)

- Must be valid

If you provide two photo identification documents, the live account can be opened.

Secondary ID – (30 points), one of the following:

- Tax bill (telephone, electricity, gas)

- Bank or credit card statement

- Tax document issued by the government

- Birth certificate

- Certificate of citizenship

Requirements

- Must have been issued within the last 6 months and show complete document

- Must show name and residence address (P.O. Boxes are not acceptable)

- Name and address shown on the document must match the application form

- Must show a service provision, such as money owed or paid out

Pepperstone makes it clear that they do not accept screenshots of any ID documents, so they recommend that all photo documents are submitted as photos (rather than a scan or photocopy).

Final thoughts on Pepperstone

As a final summary assessment we can say that we are dealing with a trusted, established and globally recognised financial intermediary.

With guaranteed security, a variety of available assets, market-leading trading platforms, advanced analysis tools and a variety of training resources, it is an excellent choice for any type of investor.

And so we conclude our review of Pepperstone’s features and reviews.

If you want to test Pepperstone’s services first hand and form your own opinion about this broker you can also open a free demo account to try out their trading platforms and see their trading commissions without putting your money at risk.

I hope that with this information you will be able to draw your own conclusions as to whether Pepperstone is the right broker for you.

If you have any doubts or have any personal opinion about Pepperstone you can write to us in the comments.

Don’t forget to share this content with your friends and on your social networks.

Thank you very much for your attention.

Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

This post is also available in Spanish: pepperstone opiniones